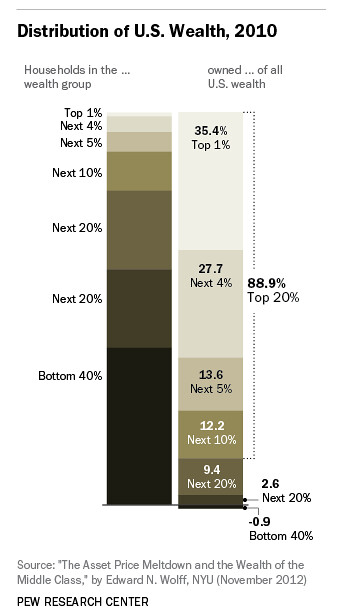

And in the same article, they show that income inequality in the country has reached a level not seen since 1928. Comparing the two charts, a clear observation emerges - it is not that the government is inefficient and ineffective in dealing with the economy; it is that they have oriented themselves to serve corporate over individual interests.

Saturday, May 31, 2014

Too Big to Fail?

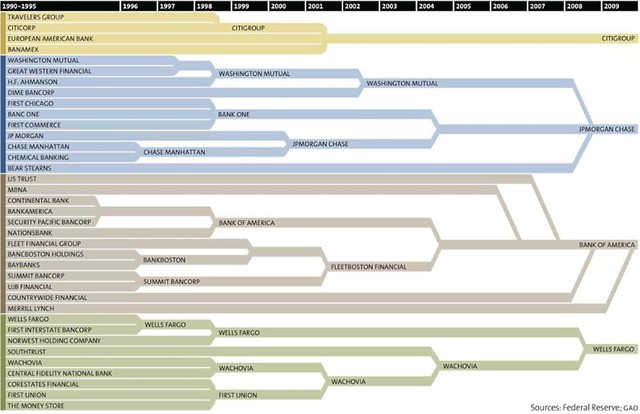

Fascinating graphics courtesy of Daily Kos The four banks listed in the infographic below — CitiGroup, Bank of America, JP Morgan Chase and Wells Fargo – have received nearly $93 billion in taxpayer funds since the bailouts began in 2008. While they make up a small percentage of the 940 bailout recipients who have, to date, received $611 billion from American taxpayers, they represent a significant chunk of those funds. More importantly, their acquisition trajectories represent the consolidation of major banking institutions in America — leading them toward the distinction of “too big to fail.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment